Get Your Free IIRMA Report!

Rated 4.7/5 - Over 83% voted “Very Helpful”

New FREE Report Reveals How To Save Your Social Security From The Government’s Outrageous IIRMA LAW

What is IRMAA?

It’s the Federal governments “Income Related Monthly Adjustment Amount” established in section 811 of The Medicare Modernization Act.

It allows the Federal Government to use your retirement savings against you… to reduce or eliminate your Social Security income by increasing your Medicare costs.

People across the country are getting letters from the Social Security Administration telling them their Social Security will be reduced or eliminated.

You can avoid this if you plan ahead.

Nothing will be sold. This is an educational event.

“When my wife saw she was losing half her social security to IRMAA she went atomic! She was so upset she couldn’t see straight.”

-Navi Dowty

“I’ve invested on my own for 40 years, and this was extremely enlightening, I had no idea any of this was going on.”

-Daniel Wade, 69

SATISFACTION GUARANTEED

Brought to you by IIRMA Educational Services¹:

Get a FREE Personalized IIRMA Expense Report To…:

Discover What IRMAA IS

See If You Are At Risk

Learn How To Avoid IRMAA to Maximize Your Retirement

In This Free IIRMA Expense Report You’ll Probably Do More To Protect Your Retirement Than Your Advisors Have Ever Done. Come and See How to Avoid IRMAA, And Get More Retirement Income & Peace Of Mind

“I’ve never seen anything that affects so many retirees so profoundly. And none of the retirement planning out there covers it!”

-Edgar P Roberts, Jr.

Rated 4.7/5 - Over 83% voted “Very Helpful”

Your Free Personalized IRRMA Expense Report Will Reveal:

Why maximizing your social security could end up being a costly mistake. (This is the OPPOSITE of what almost every financial advisor in America is teaching. They may be driving you right off an IRMAA cliff.)

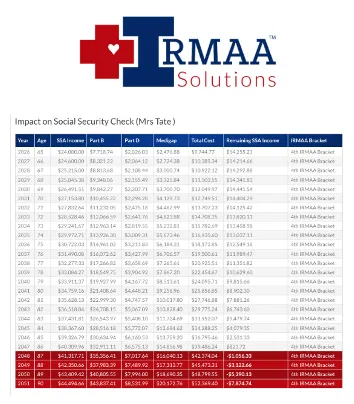

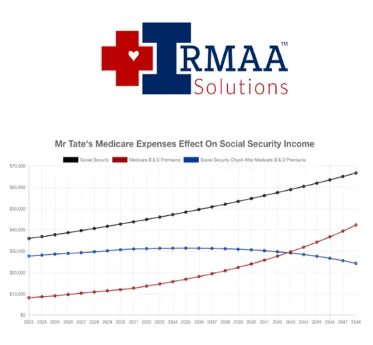

How much IRMAA may cost you.

When you may trigger an IRMAA bracket. (Knowing this allows you to shift income to other assets that may be “IRMAA FREE” income sources)

How much your Social Security could be reduced.

The 3 different “IRMAA FREE” income sources you must know about to reduce taxes and maximize retirement income.

The 3 different ways your 401(k) could be taxed.

A plan to Avoid IRMAA and maximize your retirement without the risk of losing it to the government.

How IRMAA is a blatant redistribution of wealth…and how to stop it from leeching away your wealth.

Why your spouse could be taxed on income they never receive… and how to avoid it.

Why returns on your investments matter very little for retirement success… and what matters is what the government is planning to do to your retirement income assets.

How the government is 2 steps ahead of the citizens for collecting record amounts of revenue from your retirement savings. (Why do you think they encourage everyone to defer taxes to retirement ala 401(k) and IRA? They can tax it to death and there’s nothing you can do about it.)

This free report could save you thousands, even MILLIONS in avoidable costs during retirement…and you get to see it in black and white.

Your Personalized IIRMA REPORT will be different than the one shown below, but after you receive it it will give you the necessary information to make a GAMEPLAN to help avoid triggering an IIRMA Event

“This creates even more urgency to move away from the traditional approach to retirement planning.”

-Lyndon J. Clark

Get Your Free IIRMA Report!

SATISFACTION GUARANTEED

Frequently Asked Questions

How long will it be?

The seminar will last approximately 45 minutes, plus time for questions and answers at the end.

Do I need to buy anything? Will something be sold?

No, nothing will be sold at this event. This is educational seminar only. There will be an opportunity to get help after the event if you would like more personal attention.

Is a meal included?

The content of this seminar is so important, we prefer to avoid the distraction of a meal.

Should I talk to my financial advisor or CPA first?

If your financial advisor or CPA has not told you already about IRMAA there is a good chance they are not educated adequately. They may tell you “You don’t make enough money so don’t worry about it.” This advice often doesn’t take into account growth of your assets, and changes in IRMAA brackets. IRMAA brackets can change every year, and some politicians have proposed to make them twice as onerous as they are now. If that happens, and you don’t prepare now it will most likely be too late.

What if IRMAA doesn’t affect me yet? Should I talk to my financial advisor or CPA first?

After reviewing hundreds of client’s situations, IRMAA can be significantly more costly later in retirement even if you aren’t being penalized now. Coming to the event and getting a personal software report that shows your future IRMAA costs can allow you to be sure what your future costs will be, and possibly how to avoid them.

What if I’m already taking social security?

For most people, it’s not too late to make sure you reduce or eliminate your IRMAA costs. In fact, coming to this event could save you thousands in additional costs by educating you about what financial moves to make to avoid additional IRMAA costs. (Many events can cause substantial IRMAA problems including cashing out of investments, Roth conversions, selling a business, taking too much income, etc.)

What if I can’t make it will there be another?

The experts who are traveling to do this training have schedules that take them all across the country, so we cannot guarantee there will be another one like this in your area.

Rated 4.7/5 - Over 83% voted “Very Helpful”

1: irrma educational services is a division of wealth education group.

Copyright © 2023 - IRMAA Educational Services